How do I avoid late bill payments?

- Sign Up for Autopay: Most of your regularly recurring bills—utilities, mortgage, car loan, etc.—provide you with the option of having the amount you owe automatically deducted from a designated bank account. Make it easy by making it automatic.

- Consolidate Bills: Instead of paying several separate monthly bills, why not see if you can consolidate your billing to pay for all of the services you receive in one monthly statement? You’ll be less likely to miss a due date that way. Bill consolidation works by paying off several bills with just one loan, giving you a lot less to manage every month.

- Schedule Bill-Paying Time: Set aside time on your calendar to pay bills on a regular basis in the same way that you schedule a time for the gym or work meetings. By setting aside a regular time to pay your bills, you’ll create a habit that will make you much less likely to miss a due date.

- Organize Paper Bills: Your bills should be arranged according to the due date. Create a habit of noting the due date for a bill as soon as you open it (circling or highlighting it) and then put the date on your calendar. Also, find a convenient place where you can keep and pay your bills. You may want a desk filing system where you can store bills according to due dates, so you have an immediate visual reminder of which bills need to be paid next.

- Learn Your Billing Cycle: Review several months’ worth of paid bill statements and list bills in the order that they are typically due. Most likely you’ll notice that your due dates are in one of two groups—ones due earlier in the month (e.g., the 5th) and those due later in the month (e.g., the 20th).

- Sign Up to Receive Bills or Bill Reminders Via Email: Check to see if your creditors provide online bill payment reminder features, or go paperless and have your bills sent to you electronically via email. Tip: Both Microsoft Money and Quicken have features that can prompt you days or weeks in advance of your bill due dates.

- Use Your Phone to Pay: Many creditors allow account holders to pay their bills by phone, for free or a small fee. If you regularly pay bills later, consider paying by phone instead. It’s more than likely that the fee charged for phone payment service will be less than the late fee.

How do buy now, pay later installment plans work?

This term refers to paying off a purchase in equal installments as part of a BNPL plan. There are a few restrictions to be aware of depending on the app used, but this type of program is appealing to customers who might have difficulty paying a full bill upfront. Compared to using a high-APR credit card to pay bills in 4 payments, a Pay in 4 plan is more affordable, because BNPL arrangements often don't charge interest or fees. But they have a fixed repayment schedule—generally several weeks or months. You're told upfront what you'll need to pay each time, and it's usually the same amount. It's comparable to any other sort of unsecured personal or consumer loan.

How do you improve your credit score?

- Automate your payments. That way, you’ll never miss a payment, keeping you from damaging your credit score.

- Become an authorized user. If you have a parent or family member with good credit, you can ask them to add you as an authorized user on their credit card.

- You should also keep track of your credit utilization, which is the ratio of your credit card balances to the total amount of credit you have available. It plays a big factor in calculating credit risk and therefore credit scores. When you use more than 30% of your available credit, your credit score will typically drop because it signals to credit card companies that there’s a greater risk you may not pay it all off, or that it may take a while to do so.

How do I put my utility bills on autopay?

First, you can make automated payments via ACH transactions. ACH stands for Automated Clearing House, and it refers to a form of electronic funds transfer, or EFT, to or from a bank account. When you set up automatic bill payment using your bank or credit union’s online bill payment system, for example, your biller gets paid via an ACH transfer. You tell the bank or credit union how much to pay and when to pay it each month. The bank then authorizes that amount to be deducted from your selected account each month and transferred to the company you need to pay. The second way to set up automated payments is by using your credit card. For instance, if you need to pay your Netflix or Hulu subscription each month, you could set up an automatic payment allowing those fees to be charged to your credit card.

How do you avoid a convenience fee?

For the most part, getting around a convenience fee is easy. Since only certain types of merchants charge them, you can simply use a different payment method and continue using your credit card for other everyday purchases.

How do I pay my bills with biweekly pay?

- Create your monthly budget categories: Getting paid monthly, biweekly, weekly-- it doesn’t matter. You need to know where your money is going, so start by listing out your monthly expenses, including due dates.

- Organize your bills and expenses by utilizing a bill pay calendar: Google Calendar is a fantastic free tool to help keep your finances organized and on track. Part of it is that the visualization really helps you understand what’s happening in each month, but there’s also the bonus of getting the email reminders so you don’t forget due dates or how you’ve allocated funds in your budget.

- Create a zero-based budget for each paycheck: With a zero-based budget, you’re going to look at your income and expenses and give every dollar a job to meet your financial obligations and reach your financial goals for the future. When your paycheck comes in, you are going to assign 100% of your income to an expenses or category until you have planned out every dollar.

- Track your money: Tracking where your money has gone is typically where most people get frustrated and bail, but this is a super important step in sticking with your budget and subsequently meeting your personal finance goals.

How do I pay my utility bills in installments?

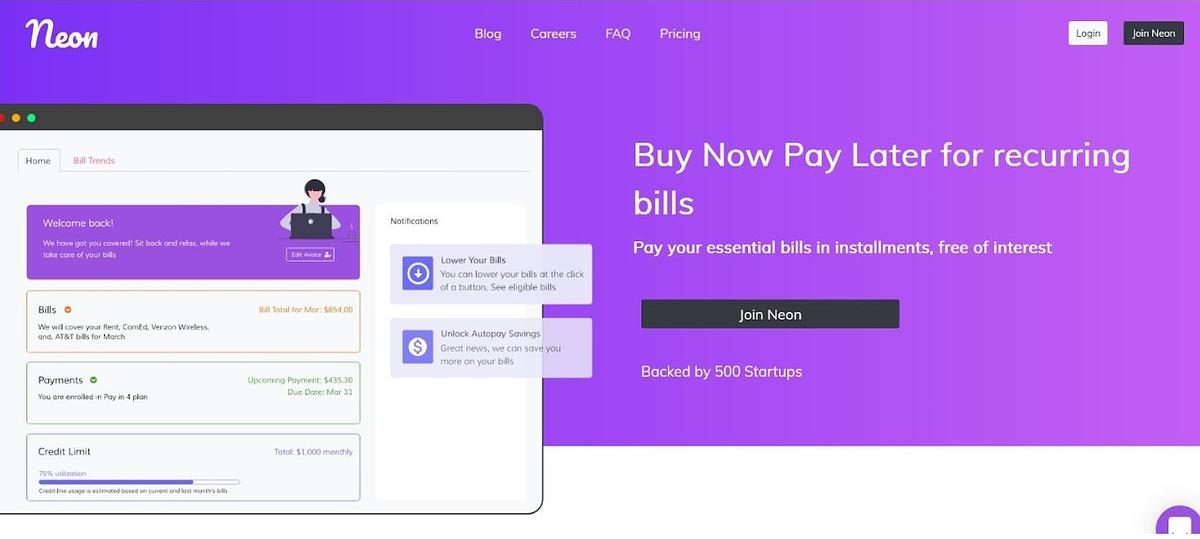

While Buy Now Pay Later has exploded in popularity for e-commerce and even in-store shopping, it is still rare to find a company that offers Buy Now Pay Later for bills. A great option is NeonForLife, which consolidates all of your bills on one platform and lets you split them into installments, using its own thorough credit decisioning process to help you qualify for its $2,000 credit line. This is super helpful for those with thin credit files, no credit, or bad credit. It’s also very convenient because with its Autopay feature, it can pay your bills for you. Look below to find out how to get started with Neon.

How do I sign up with Neon?

- Go to neonforlife.com

- Select “Join Neon” at the center or the top right and fill out the form according to the prompts.

- Select your state to make sure that Neon is available where you live.

- Create an account with Neon. You will need to verify your phone number with a one-time password.

- Once you answer a few quick questions, you will be directed to your dashboard.

- Complete KYC to apply for Neon’s $2,000 credit line.

- Add the details of the bank account that you would like to pay with.

- Finally, add your bills. Now, you’re all set!

How do I use Neon?

Once you’ve signed up and have your account ready, all that’s left is to give Neon the information to pay your bills for you.

- Apply for a credit line. This won’t affect your credit score, and even if you don’t have a lot of credit history, you still may get it.

- Add your bills. To do this, you’ll need to provide the credentials of your accounts with your utility bill providers.

- Connect a bank account that you want to pay with.